German industrial manufacturing suggests ‘finish of stagnation’

Higher-than-expected German industrial manufacturing figures launched Monday recommend “an finish of stagnation within the first quarter,” Carsten Brzeski, world head of macro at ING, mentioned in a be aware.

Industrial manufacturing rose by 2.1% month-on-month in February, nicely above the 0.3% development anticipated by analysts polled by Reuters.

“Whereas sentiment indicators in German trade have been caught at low ranges since late final summer time, this morning’s industrial knowledge already factors to an finish of stagnation within the first quarter,” Brzeski mentioned.

The anticipated reducing of rates of interest by the European Central Financial institution, decrease vitality costs and U.S. financial power shall be supportive for German trade, he mentioned.

Nevertheless, he pressured it was not the beginning of a “important restoration” given latest weak spot in industrial orders and stock discount.

— Jenni Reid

Gold appears to be like ‘very susceptible’ to a setback, veteran advisor says

Gold costs on Monday prolonged their record-breaking run, notching one other all-time excessive amid strong U.S. financial knowledge and elevated geopolitical tensions.

Spot gold costs rose 0.5% to commerce at $2,342 per ounce at round 11:45 a.m. London time, after briefly hitting a recent file of $2,353 earlier within the session. The yellow steel has repeatedly logged all-time highs in latest weeks.

Nevertheless Bob Parker, senior advisor at commerce physique Worldwide Capital Markets Affiliation, says that fundamentals for gold paint a bearish image forward. That features U.S. greenback power, rising bond yields, doubts creeping in over the Federal Reserve’s price reducing plans and “fairly” low inflation.

“All of these components really recommend that upside in gold, frankly, is minimal and I feel gold is now very susceptible to a setback,” Parker mentioned.

Learn the total story right here.

— Sam Meredith

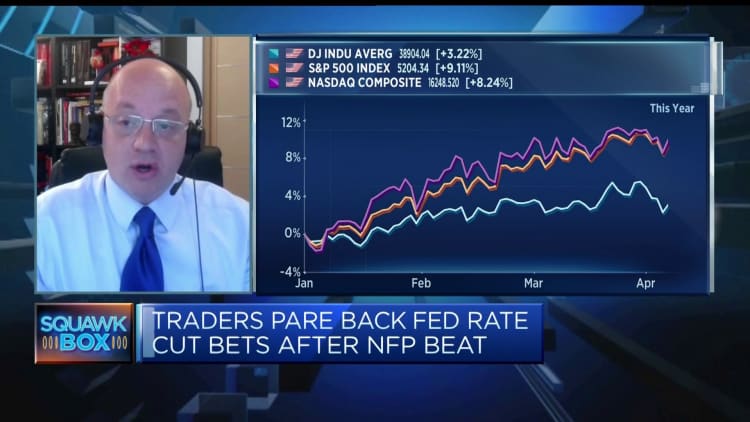

Economists are more and more unsure about Fed price cuts this 12 months

The Federal Reserve is set to not scale back rates of interest too quickly — and a few economists say latest knowledge has pushed a summer time reduce fully off the desk.

Friday’s jobs report reiterated the seemingly unwavering power of the U.S. labor market and instructed additional want for Fed warning. All eyes will now be on Wednesday’s shopper value index, after February’s annual inflation price of three.2% got here in barely greater than anticipated.

George Lagarias, chief economist at Mazars, instructed CNBC on Monday that price cuts in the summertime had been now wanting a lot much less seemingly.

“It is a robust economic system. Make no mistake, it’s backed by debt and considerably by overburdened bank cards, however it’s a robust economic system. So the Fed will battle to seek out the case to chop charges quickly,” Lagarias mentioned.

“The Fed has been punishing itself ever since 2021 when ‘crew transitory’ ostensibly acquired it flawed… What they really feel is that they cannot get it flawed once more, which implies that they’re extra prone to err on the facet of warning,” Lagarias added.

Learn the total story right here.

— Jenni Reid

Atos shares leap 30% after Butler joins rescue consortium

Atos share value.

Shares of French IT consultancy Atos had been 30% greater in mid-morning offers after main shareholder Onepoint mentioned investor Butler Industries was becoming a member of a consortium to rescue the agency.

French Prime Minister Gabriel Attal final week mentioned it was a nationwide precedence to safe the monetary safety of the distressed firm. Its initiatives contain communications for the French navy and secret companies and supercomputer manufacturing, and it’s set to handle cybersecurity for this summer time’s Paris Olympics.

— Jenni Reid

Shares on the transfer: Zalando and Entain acquire, BBVA decrease

A Ladbrokes betting store, operated by Entain Plc, in London, U.Ok., on Wednesday, Sept. 22, 2021.

Chris J. Ratcliffe | Bloomberg | Getty Photos

Shares of German retailer Zalando had been up 4.75% in early offers after Citi analysts upgraded the inventory to “purchase” from “impartial.”

Among the many high risers, playing agency Entain ticked 3% greater after a report within the Instances newspaper instructed personal fairness corporations are excited by a few of its property.

Financial institution BBVA slipped 3.4% after asserting a ultimate dividend of 0.39 euros ($0.42) per share to be paid Wednesday.

— Jenni Reid

Europe shares open blended

European markets had a cautious begin to the week, with the benchmark Stoxx 600 index 0.06% decrease at 8:05 a.m. in London.

France’s CAC 40 and the U.Ok.’s FTSE 100 had been each close to the flatline, whereas Germany’s DAX nudged 0.2% greater.

Stoxx 600 index.

CNBC Professional: Goldman Sachs simply up to date its record of high world shares, recommending a selected buying and selling technique

Regardless of logging a lackluster efficiency final week, the pan-European Stoxx 600 index is round 7.5% greater year-to-date and up over 15% over the past 12 months.

Nevertheless, Goldman Sachs’ analysts famous that traders are “questioning how a lot upside is left” and advisable that traders think about a selected buying and selling technique.

Additionally they up to date their “conviction record” of high inventory picks for April.

CNBC Professional subscribers can learn extra right here.

— Amala Balakrishner

Financial institution of America says this week’s CPI needs to be ‘a confidence constructing report’

Financial institution of America economists consider Wednesday’s inflation report ought to present a moderation in value pressures, offering confidence to the Fed for a price reduce in June.

The Wall Avenue agency expects the core shopper value index to reasonable to 0.2% in March after rising 0.4% in February and January. It sees declines in automotive costs that ought to result in a drop in core items. In the meantime, the financial institution expects a bigger-than-usual rise in vitality costs, nonetheless.

“The moderation in core CPI ought to replicate a drop in core items costs and a extra modest value improve in core companies,” the financial institution’s economists mentioned in a be aware. “A report in keeping with our expectations would offer confidence to the Fed and maintain a June reduce firmly in play.”

— Yun Li

CNBC Professional: ‘Huge bargains’: Morgan Stanley names 3 ignored world tech shares to purchase

Morgan Stanley names three “ignored” world tech shares that it says look low-cost proper now.

The financial institution mentioned the theme of “broadening out” is about to change into extra essential, and “traders will more and more look to high quality small caps at enticing valuations as sources of alpha.”

It’s overweight-rated on all three shares and provides one practically 100% upside.

CNBC Professional subscribers can learn extra right here.

— Weizhen Tan

European markets: Listed here are the opening calls

European markets are heading for a better open Monday.

Based on IG knowledge, the FTSE 100 is about to open 11 factors greater at 7,913, with Germany’s DAX up 29 factors to 18,191 and France’s CAC 40 greater by 21 factors at 8,078.

— Jenni Reid

Fri, Apr 5 20248:44 AM EDT

U.S. provides 303,000 jobs in March, topping estimates

A “Now Hiring” signal for Nugget Markets is posted on the facet of a Golden Gate Transit bus in San Rafael, California, on July 7, 2021.

Justin Sullivan | Getty Photos

The March nonfarm payrolls got here in stronger than anticipated Friday morning, which is one other signal of a resilient U.S. labor market.

The U.S. economic system added 303,000 jobs final month, topping the 200,000 anticipated by economists surveyed by Dow Jones. The unemployment price was 3.8%.

Common hourly earnings rose 0.3% in March, and are up 4.1% over the previous 12 months. The typical workweek ticked as much as 34.4 hours.

— Jesse Pound